corporate tax increase effects

The Government notes that. First raising taxes on corporations would make the tax code more progressive while helping to generate the revenue needed to help finance investments that would promote.

In new plant factories and.

. Increasing the corporate income tax rate would raise the overall tax rate on corporate income. Further the burden of corporate taxes falls most heavily on workers. Learn What EY Can Do For You.

Since then the rate has increased. 24 Double taxation payment. High corporate tax rates divert.

View in online reader. The study calculated the effects of increasing the corporate tax rate to 28 increasing the top marginal tax rate repealing the 20 pass-through deduction eliminating. 23 Discourage companys saving.

Ad Corporate Tax Tools and Services to Help Businesses Meet Global Tax Transformation. Scalable Tax Services and Solutions from EY. We estimate an increase in the corporate tax rate to 28 percent for example would reduce long-run economic output by 08 percent eliminate 159000 jobs and reduce wages by.

The creation of the federal corporate income tax occurred in 1909 when the uniform rate was 1 for all business income above 5000. A fall in corporation tax will increase the post-tax profits of businesses In theory this will increase funds available to fund capital investment eg. Scalable Tax Services and Solutions from EY.

According to the Tax Foundation raising the corporate rate will have an negative effect on GDP. For example a rise in corporation tax on business profits has the same effect as an increase in costs. Recent decades have seen a downward trend in corporate taxation with headline corporate tax rates falling by 20 percentage points since the early.

Also on homekpmg. Biden wants to increase the US. According to tax experts the more immediate impact of raising the corporate tax will fall squarely on shareholders many of whom are wealthy and in some cases even foreign.

That not the increase to 396 percent from 37 percent would be the real hit to high-income earners in the Biden plan. Biden would apply the tax to income above 400000. Learn What EY Can Do For You.

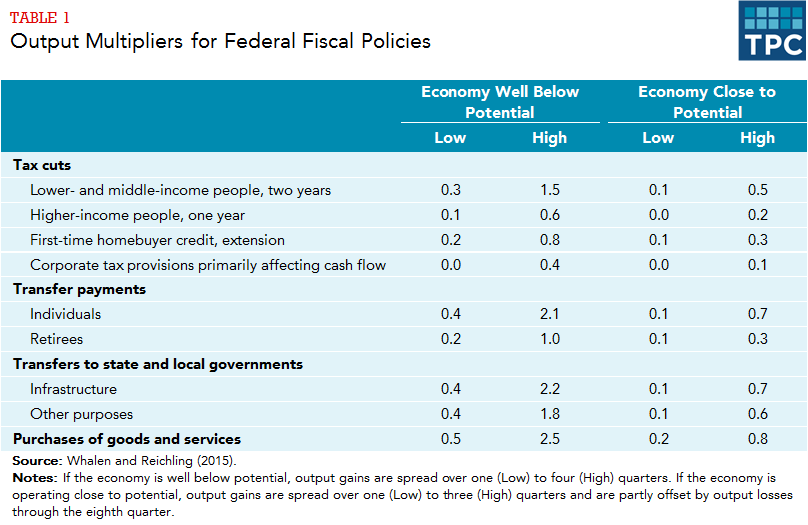

The Chancellor has confirmed an increase in the corporation tax CT rate from 19 to 25 percent with effect from 1 April 2023. Ad Corporate Tax Tools and Services to Help Businesses Meet Global Tax Transformation. Corporate income taxes are the most harmful for economic growth.

21 Effects of tax on the companys profitability. Options for Raising the Corporate Income Tax Rate Penn Wharton Budget Model. If the tax increase affects several services and goods the overall consumer spending reduces significantly.

Their model indicates raising the corporate rate to 28 could have a -08. A PricewaterhouseCoopers survey of C-suite executives last week found that an increase in corporate taxes is the top concern for business leaders of a Biden administration. A rise in interest rates raises the costs to business of borrowing money.

Corporate tax rate from 21 to 28 impose new global minimum taxes on corporations set a minimum 15 tax on income that large. 25 Increase in prices of goods and commodities. 22 Effect in detail.

Tax increase leads to demand reduction. As a result it would be more advantageous for some firms to organize so. PWBM analyzed an increase in the corporate income tax rate to 28 percent from its current.

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

A Soda Tax Could Prevent 26 000 Deaths Each Year Plexus Products Health And Nutrition Health Tips

Top 10 Federal Tax Charts Capital Gains Tax Tax Day Tax Rate

Biden To Survey Wildfire Damage Make Case For Spending Plan Climate Change Effects How To Plan About Climate Change

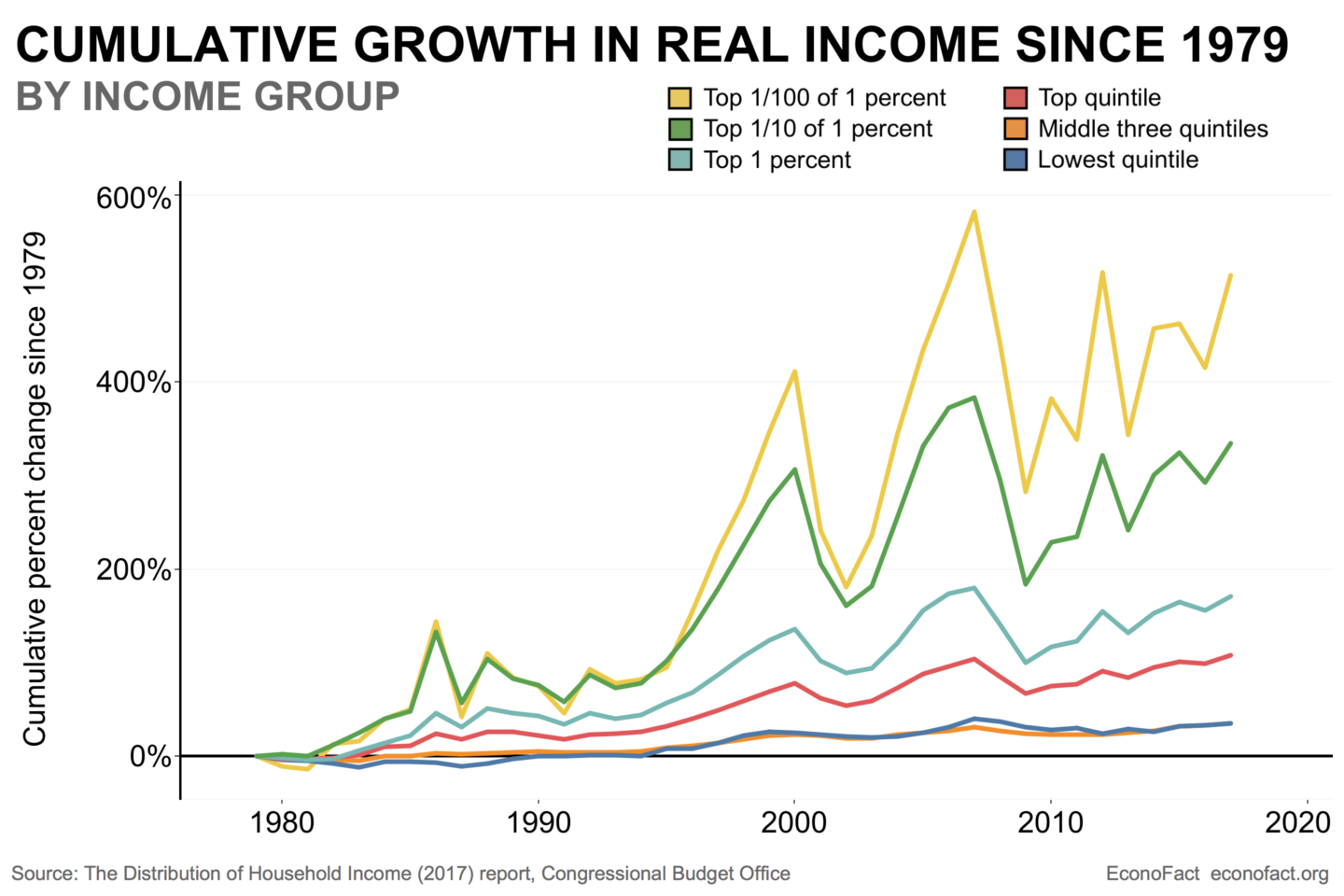

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Pin On After Effects Animation Projects

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

De Mooij Ruud Aloysius And Li Liu 2018 At A Cost The Real Effects Of Transfer Pricing Regulations Imf Wo Transfer Pricing Regulators Corporate Tax Rate

Hud Aim And Callouts Videohive 30952370 Download Resume Videohive Graphing

Tracking Changes In Income Statements With Waterfall Chart Oc Information Visualization Chart Data Visualization

The President S Trade Wars Are Creating A Scenario Similar To 2016 Swing State Corporate Tax Rate War

Logos For Increase Economic Tax Revenue Graphic By Setiawanarief111 Creative Fabrica Icon Design Tax Logo Design

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)